California’s Zero Emission Vehicle (ZEV) mandate, which requires 100% of new cars sold in the state be zero-emissions by 2035, was recently invalided by the Trump Administration’s actions that repealed the state’s authority under the Clean Air Act to enact the Advanced Clean Cars II regulation. In response, Governor Gavin Newsom and Attorney General Rob Bonta then sued in order continue implementing the current regulations. At the same time, the governor also issued an Executive Order requiring the California Air Resources Board (CARB) to begin new mandates under Advanced Clean Cars III.

With increased attention on the ACC II mandates, and the potential for new mandates under ACC III, it is important to understand exactly what is at stake for California consumers and the economy. Most importantly, as the governor directs CARB to begin yet another set of regulations under ACC III, it is important to understand how aspirations and goals quickly turn into expensive mandates in the hands of unelected bureaucrats at state agencies and departments. The ZEV mandate began with an executive order from Governor Gavin Newsom, with regulations being created by the California Air Resources Board (CARB). The regulation now includes expensive penalties, without any oversight or approval of the Legislature or any elected body.

Unfortunately, the regulatory overreach and massive penalties imposed by CARB through ACC II are not unique. They are part of a persistent and growing pattern of expensive mandates and regulations being created by state agencies, who are unaccountable for the costs and ramifications of their actions. The Legislature does not approve regulations, regardless of the cost, and yet it’s their constituents who pay the price for these costly policies.

So while this analysis is focused on ACC II, it is important to note this is just one of many regulations created by state agencies that are driving up the cost of living and having a major impact on our entire economy.

The Advanced Clean Cars II ZEV Mandate: Where It Stands Today

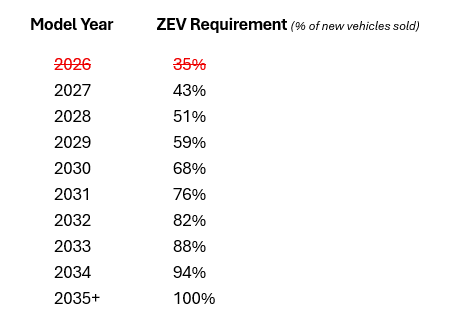

Even before the president took action last week, California regulators had already quietly taken action to delay the mandates in ACC II. In late-May, CARB released new regulations delaying by one year the implementation of the ZEV mandate. Why delay a mandate that is a decade away? Because it isn’t. The mandate, as passed by CARB, began with 2026 model year vehicles, which are being released right now by many car manufacturers.

While California is fighting in court for its right to implement the 2035 ZEV mandate, regardless of the year delay in enforcement, the policy is not a decade away; it is right around the corner.

And here’s how it works…

CARB’s ZEV Mandate Doesn't Start in 2035

While much of the public believes California’s ban on new gas-powered cars begins in 2035, the real start date is now the 2027 model year (about a year away). The California Air Resources Board’s Advanced Clean Cars II (ACC II) regulation mandates that 43% of 2027 model year vehicles sold in California must be zero-emission vehicles (ZEVs). While CARB delayed the implementation date, it did nothing to change the mandated number of vehicles sold, which means it has only delayed by a year a mandate that consumer demand is not close to meeting.

Will California Meet Its 2027 Mandate?

Not yet. According to the Energy Commission’s own data:

As of 2024, only 25.3% of new vehicles sold in California were ZEVs (including battery electric, plug-in hybrid, and fuel cell vehicles), dropping further to 23.0% in the first quarter of 2025. That’s about 443,000 ZEVs sold in 2024.

To meet the revised 2027 target, California would need to increase ZEV sales by about 50% from current levels — rising from approximately 23% today to 43% in less than 24 months.

California would have to sell about 735,000 ZEV vehicles in 2027 to meet the mandate—a whopping 66% more than were sold in 2024.

These numbers only apply to California—by far the largest ZEV market in the US. But 11 other states and DC have adopted the ACC II regulations (section 177 states), with 5 of them with mandates also beginning in 2026. Combined with California, total ZEV sales in 2024 were only 16.7%, setting the stage for even higher fines and penalties.

Like California, several of these states have delayed enforcement as well, citing market, cost, and infrastructure concerns. Vermont and Oregon have delayed implementation to 2027, Massachusetts to 2028, and Maryland to 2029.

Many manufacturers are already signaling they will fall short, triggering compliance costs and fines — costs that will be passed on to buyers.

What Happens When Automakers Miss the Target?

Manufacturers that don’t hit the 43% ZEV mandate in 2027 have only three years to make it up (more on that rolling three-year penalty deadline below). After that:

They face penalties of up to $23,000 per non-compliant vehicle under Health & Safety Code §43211.

Other penalties under separate statutes can reach $42900 per violation.

Using expected 2027 new vehicle sales assuming no change from California New Car Dealers Association 2025 projections and ZEV market share that has been little changed over the past 8 quarters, total penalties would be up to an estimated $6.9 billion in 2027, rising to $10.4 billion in 2028.

It Only Gets Worse—and More Expensive—from Here

Every model year after 2027, the percent mandate for ZEVs increases, creating a compounding impact for California drivers and vehicle manufacturers. In essence, the program established by CARB makes it nearly impossible for a manufacturer to meet the mandate, guaranteeing rapidly higher costs for car makers and ultimately California drivers.

Understanding the Three-Year Penalty Gap

While the mandate goes into effect in 2027, CARB’s regulations allow manufacturers three years to meet the mandate before penalties are assessed. However, the ZEV mandate increases each year, and the penalties keep adding up. In other words, in 2030, manufacturers must comply with:

68% ZEV requirement for the 2030 model year, plus

Make up the 2027 shortfall:

2027 mandate: 43%

2027 actual sales: ~25%

Deficit carried forward: 18%

Therefore, the effective ZEV sales requirement in 2030 (assuming total sales remain constant) becomes:

2030 Mandate (68%) + 2027 Deficit (18%) = 86% Actual Mandate

But it only gets worse from there. Because the mandate increases each year, so will the gulf between mandate and sales. For example, ZEV sales have been relatively flat for 8 consecutive quarters. Assuming that continues, the effective ZEV sales requirement for 2031 becomes:

2031 Mandate (76%) + 2028 Deficit (51-25 = 26%) = 102% Actual Mandate

It’s these compounding mandates set by CARB that drive up costs so quickly for manufacturers and ultimately consumers. It also means that, given the compounding percentages, the mandate will likely go into effect four years before the deadline set by the governor.

What It Means for California Consumers Now

California drivers will end up footing the bill for yet another CARB regulation done in secret without any oversight or approval from the Legislature. It’s these regulatory costs that have created the cost-of-living crisis we are in today, and policies like the ZEV mandate will only make it worse. Penalty assessments may not start until 2030, but automakers will begin to make decisions now that will drive up costs and reduce availability. For example:

Because ZEV sales have all but stagnated, manufacturers will have to reduce the availability of gas-powered vehicles for sale in order to reduce the ZEV mandate deficit

Reduced inventory will drive up the cost of vehicles available for sale

Moreover, automakers are more likely to reduce base-model inventory, as those are the least profitable vehicles sold

With CARB once again regulating artificial shortages for another essential product, purchase prices will go up

Therefore, it’s Californians who can least afford it who will end up paying the most for CARB’s mandate

California’s air quality won’t get any better. Californians with older gas-powered cars will not be able to buy more efficient gas-powered or ZEV vehicles, meaning older, higher-polluting vehicles will stay on the road longer.

What is ACC III and What Does It Do?

On June 12, Governor Newsom issued Executive Order N-27-25 in response to recent federal attempts to revoke California’s Clean Air Act waiver, which authorizes the state’s zero-emission vehicle (ZEV) mandates. Rather than back off, the state is escalating its efforts. The order directs CARB to develop a new “Advanced Clean Cars III” regulation if the courts uphold the federal disapproval, and commits the state to prioritize taxpayer subsidies and fleet contracts for automakers that continue to comply with the ZEV mandate voluntarily — even if federal legal authority is withdrawn. This means the state’s aggressive push toward ZEVs will continue regardless of legal uncertainty, raising new concerns about regulatory overreach, market distortion, and how much more consumers may be asked to pay to sustain the state’s climate agenda. Moreover, it doubles down on giving unelected agencies and departments nearly unchecked authority to create costly mandates paid for by consumers, driving up the cost of living and making it even more expensive to live and do business in this state.

Key cost-drivers in the new Executive Order:

Mandates continued acceleration of ZEV targets — even if federal courts strike down California’s legal authority. This creates legal uncertainty and forces automakers to plan around the most aggressive timeline, leading to higher compliance costs that will be passed on to consumers in the form of more expensive vehicles.

Directs CARB to develop a new “Advanced Clean Cars III” regulation to go even further than ACC II, adding yet another layer of regulation. This increases regulatory complexity and compliance burdens, especially for smaller manufacturers, driving up vehicle development and distribution costs.

It’s this type of near carte-blanche authority given to CARB that leads to unchecked and expensive regulations like ACC II. Once again, no authority or oversight is provided to the Legislature once the regulations are drafted, repeating the same pattern that created the massive cost increases in ACC II.

Prioritizes taxpayer-funded subsidies and fleet contracts for manufacturers that comply — even if the law is overturned. This means public dollars will be funneled to select companies, diverting funds from broader infrastructure or affordability investments that could benefit all Californians.

Creates a public list of “compliant” manufacturers and fleets that continue following the mandate voluntarily.

Requires ongoing reporting and monitoring of manufacturers under the Clean Truck Partnership. These administrative burdens will raise compliance costs for the trucking and logistics sectors, which will be passed on through higher shipping costs and product prices.

Orders a 60-day interagency review to identify additional mandates, including charging infrastructure enforcement and expanded regulatory strategies.